New Delhi:

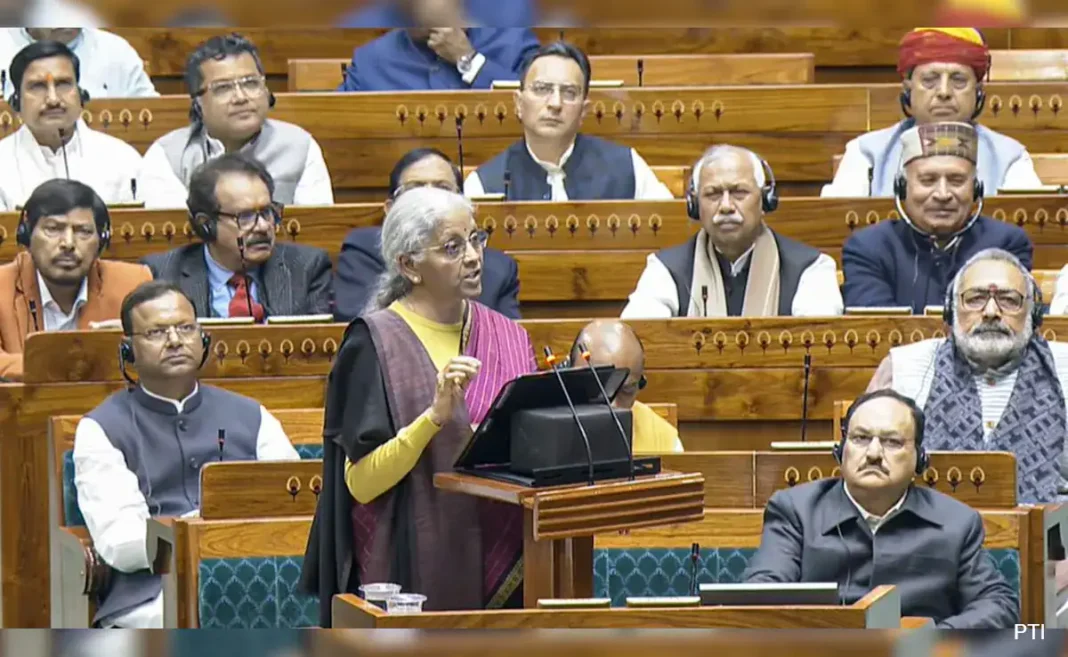

Finance Minister Nirmala Sitharaman on Saturday presented the Union Budget 2026 in Parliament, outlining the government’s economic priorities amid global uncertainties and post–Operation Sindoor geopolitical challenges. While the Budget avoided major populist announcements for individual taxpayers, it focused strongly on defence preparedness, healthcare affordability, infrastructure expansion, and long-term fiscal stability.

Table of Contents

Sitharaman spoke for 85 minutes in the Lok Sabha, presenting a budget that steers clear of direct election-oriented promises, despite several key states heading to the polls later this year. Wearing a traditional Kanchipuram saree from Tamil Nadu, the Finance Minister emphasised continuity, resilience, and strategic investment over short-term relief.

No Relief in Income Tax Slabs, Easier Compliance Promised

In a move likely to disappoint the middle class, the government announced no changes in income tax slabs. However, to ease compliance, taxpayers will now get three additional months to file revised returns, extending the deadline from December 31 to March 31.

The Finance Minister also announced that the new Income Tax Act will come into force from April 1, 2026, with simplified and redesigned forms aimed at making tax filing more user-friendly.

Defence Budget Sees Sharp Increase After Operation Sindoor

One of the most significant highlights of Budget 2026 was a substantial increase in defence spending. The defence budget has been raised by 15.2%, from ₹6.81 lakh crore to ₹7.85 lakh crore, reflecting heightened security concerns following Operation Sindoor.

Capital expenditure for weapons procurement and military modernisation will rise by 22%, reaching ₹2.19 lakh crore. Allocations include ₹64,000 crore for aircraft and aero-engine development, ₹25,000 crore for strengthening the naval fleet, and ₹1.71 lakh crore earmarked for defence pensions.

Healthcare Boost: Cancer and Rare Disease Medicines Made Duty-Free

In a major relief for patients, the government removed basic customs duty on 17 imported cancer medicines, which earlier attracted a 5% duty. Additionally, medicines for seven rare diseases, including haemophilia, sickle cell disease, and muscular dystrophy, have also been made duty-free, significantly reducing treatment costs.

Seven High-Speed Rail Corridors Announced

The Budget unveiled plans for seven new high-speed rail corridors, connecting major cities such as Mumbai–Pune, Pune–Hyderabad, Hyderabad–Bengaluru, Hyderabad–Chennai, Chennai–Bengaluru, Delhi–Varanasi, and Varanasi–Siliguri. The move is expected to transform intercity travel and boost economic activity.

Ayurveda, Medical Tourism and Education Initiatives

The government announced the establishment of three Ayurvedic AIIMS and the creation of five medical tourism hubs. A ₹10,000 crore investment will be made over five years to train one lakh specialised healthcare professionals, positioning India as a global biopharma manufacturing hub.

In education, content creator labs will be set up in 15,000 secondary schools and 500 colleges, while girls’ hostels will be constructed in nearly 800 districts, ensuring one hostel per district.

Focus on Women, Cities and Green Growth

To promote women-led entrepreneurship, SHE-Marts will be launched under the ‘Lakhpati Didi’ model, allowing self-help groups to directly sell their products. For urban development, ₹12.2 lakh crore has been allocated to improve infrastructure in Tier-2 and Tier-3 cities with populations exceeding five lakh.

Green initiatives received a boost as the government expanded tax exemptions on machinery used for lithium-ion battery manufacturing and removed duties on key solar panel components, aiming to reduce the cost of electric vehicles and renewable energy production.

Fiscal Discipline and Borrowing Plan

The government reiterated its commitment to fiscal consolidation, targeting a reduction in public debt to 50% of GDP by 2030–31. The fiscal deficit has been brought down to 4.4% in 2025–26 and is projected to fall further to 4.3% in 2026–27.

For the next financial year, the government estimates total revenue of ₹36.5 lakh crore against an expenditure of ₹53.5 lakh crore. To bridge the gap, it plans to borrow ₹11.7 lakh crore from the market, with additional funds coming from small savings schemes.

A Budget of Stability, Not Surprises

Overall, Budget 2026 prioritises strategic spending, defence readiness, healthcare affordability, and long-term economic stability over immediate tax relief. While it may not deliver instant gains for the common taxpayer, the government has positioned it as a roadmap for sustained growth and national security in a challenging global environment.